36+ Student loan amortization calculator

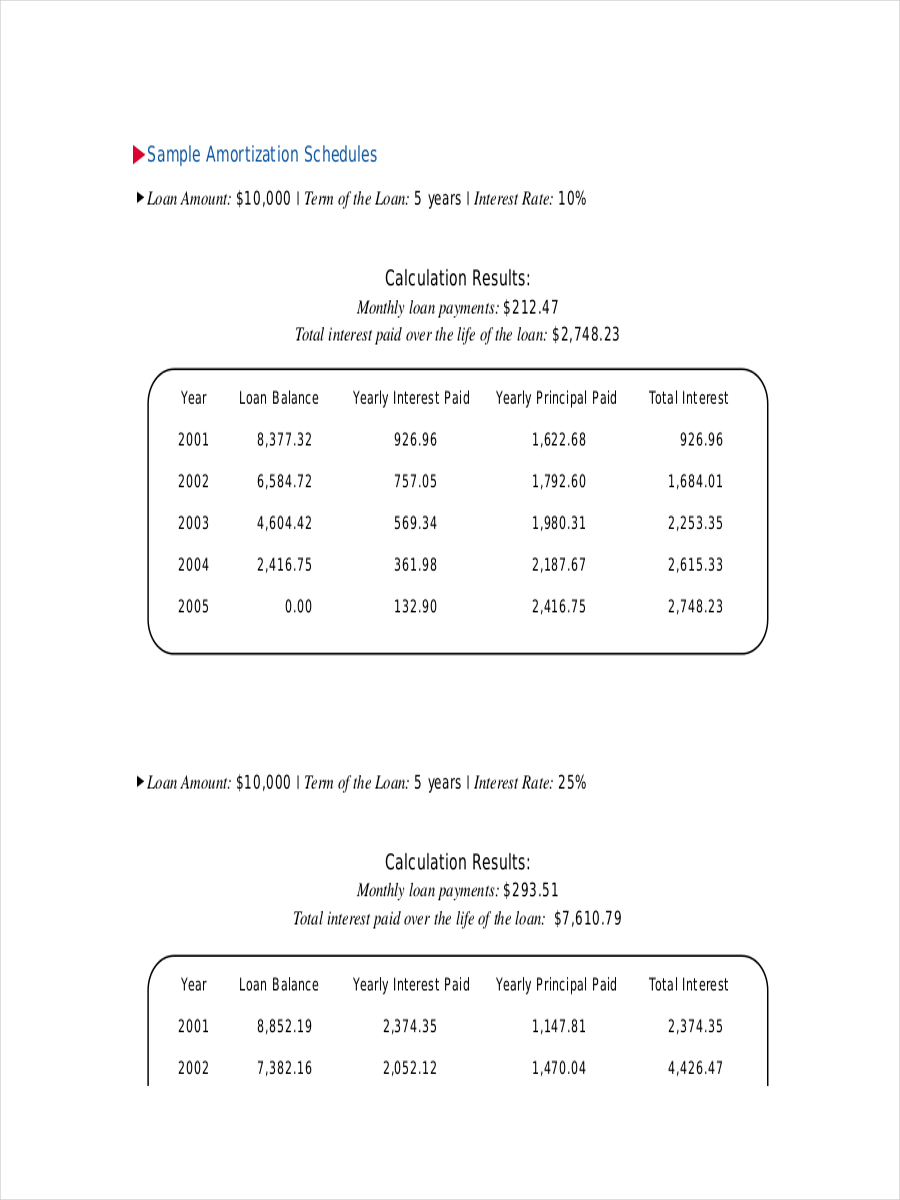

As a quick example if you owe 10000 at 6 per year youd divide 6 by 12 and multiply that by 10000. Student loans typically have a required minimum monthly payment of 5000.

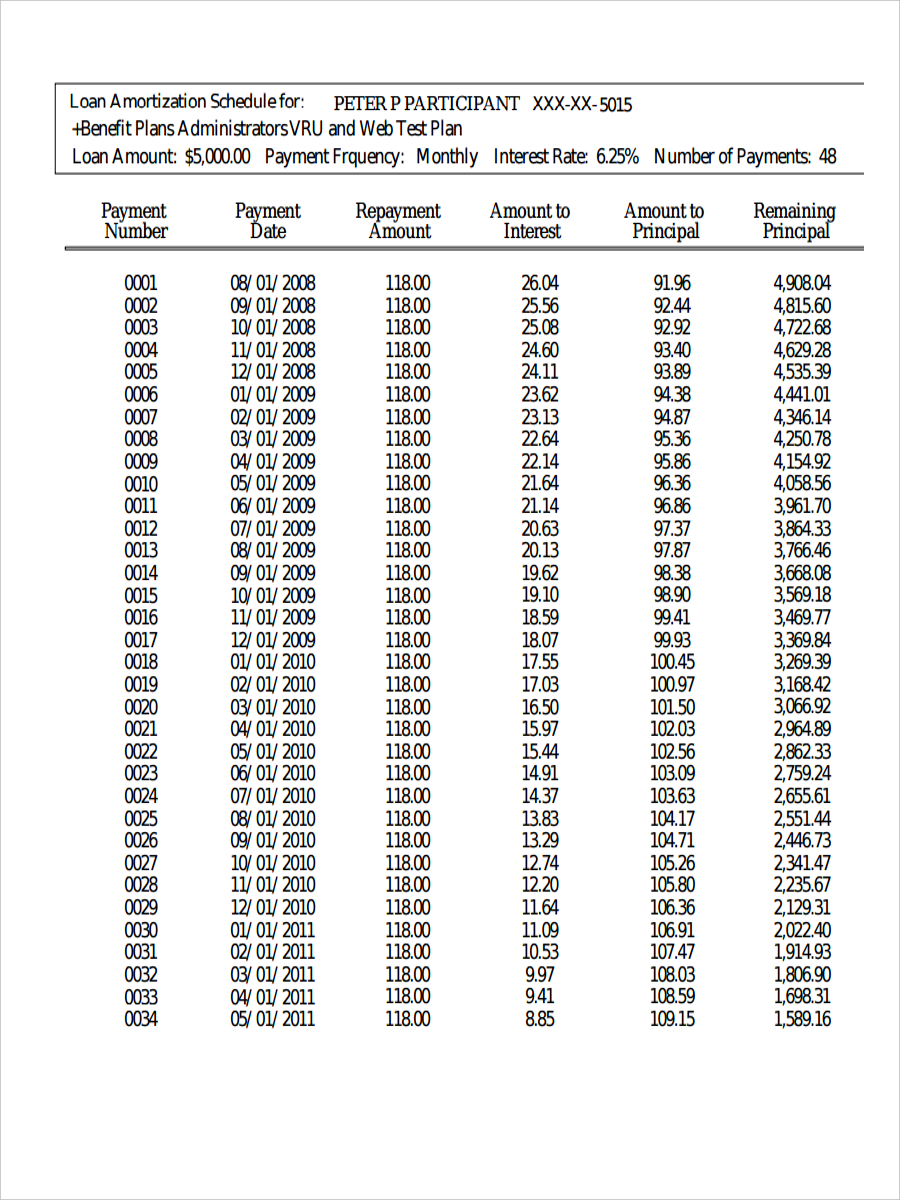

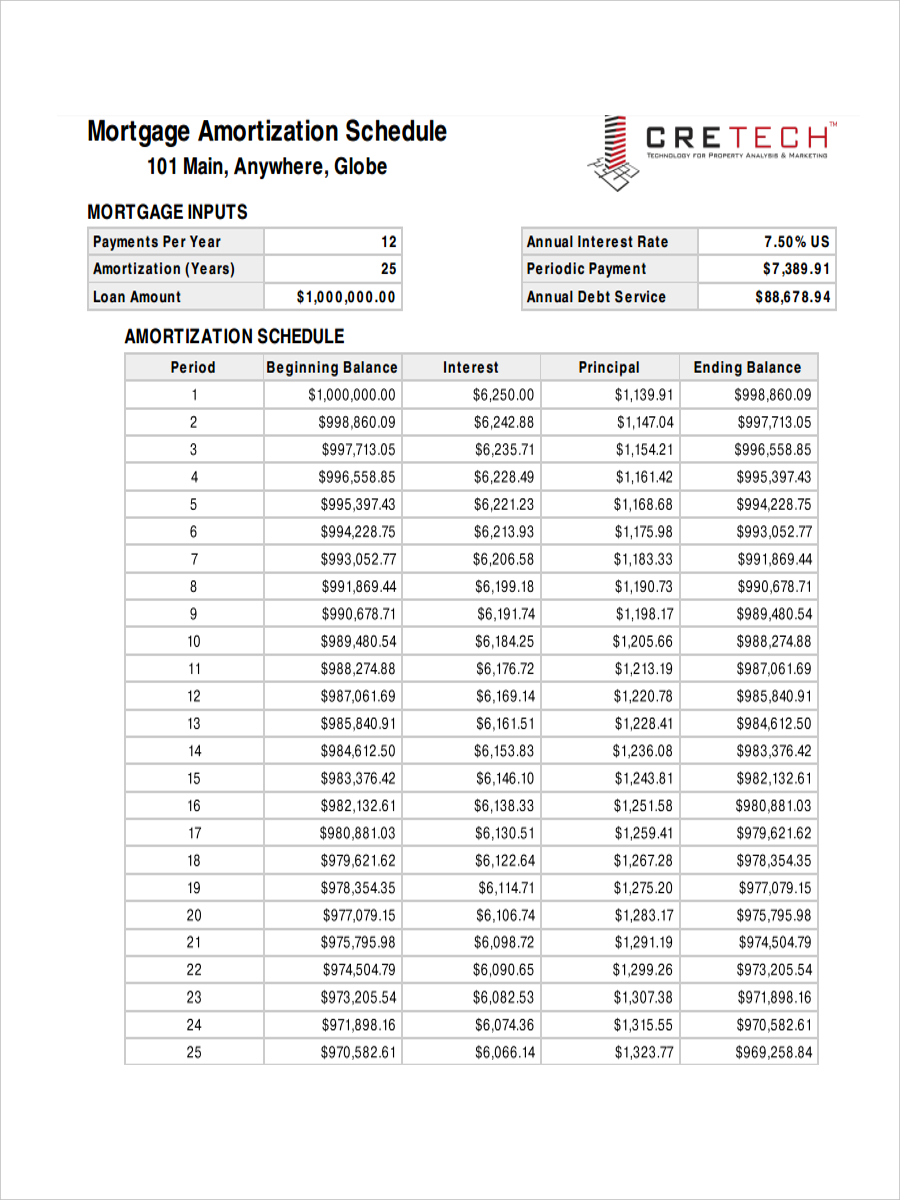

Loan Amortization Schedule Amortization Schedule Schedule Template Loan Repayment Schedule

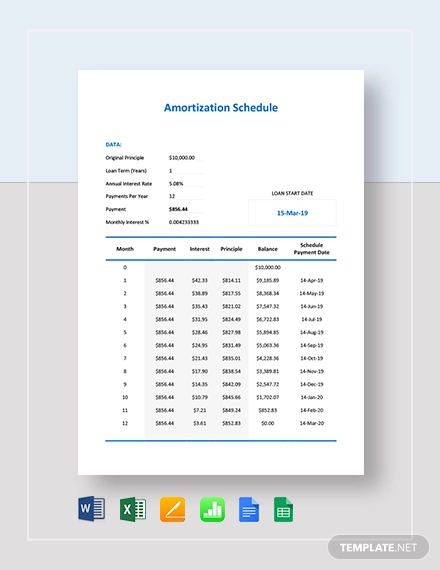

Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel.

. It also determines out how much of your repayments will go. If the estimated monthly payment is less than the minimum your estimate will reflect 5000 and your. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments.

Terms for private student loans can be as short as five years and as long as 20 years. Like private student loan amounts private student loan repayment terms vary by lender. Use the calculator below to estimate the loan balance and repayment obligation after graduation.

Just enter the loan amount interest rate loan duration and start date into. To keep student loan repayment affordable it is recommended not to borrow more than you can pay back using 10 of your monthly income. Federal Student Aid.

Use the loan calculator if you know the amount you expect to borrow. We accept no responsibility for errors or omissions caused by this loan. Once you have an idea of the APR and terms available to you from lenders you can input those new.

41 rows This amount would be the interest youd pay for the month. A student loan refinancing calculator can help you determine how much you can save. This calculator is mainly for those still in college or who.

Get a student loan amortization schedule that has all the details about principle interest and. Student Loan Calculator to quickly calculate the monthly payments for your student loan. Use the calculator below to estimate the loan balance and repayment obligation after graduation.

Find your ideal payment by changing loan. The loan amortization calculator with extra payments gives borrowers 5 options. The first is the systematic repayment of a loan over time.

The amortization of the loans over time is calculated by deducting the amount you are paying towards the principal each month from your loan balances. Lets say you want to borrow 10000 to update part of your home. Under these parameters you.

Use this loan calculator to determine your monthly payment interest rate number of months or principal amount on a loan. The principal portion of the monthly. The lender has offered 599 APR.

It also determines out how much of your repayments will go. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. There are two general definitions of amortization.

The second is used in the context of business. Student Loan Projection Calculator.

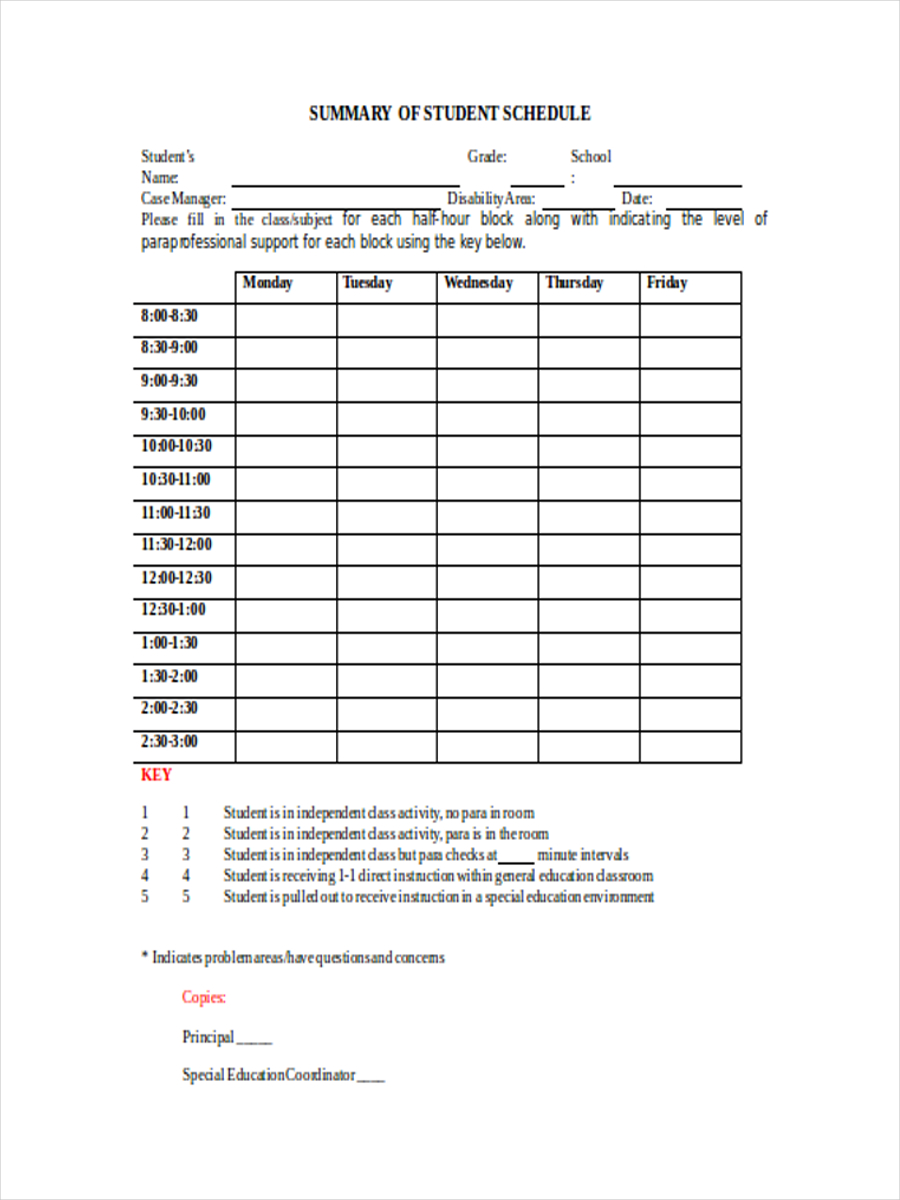

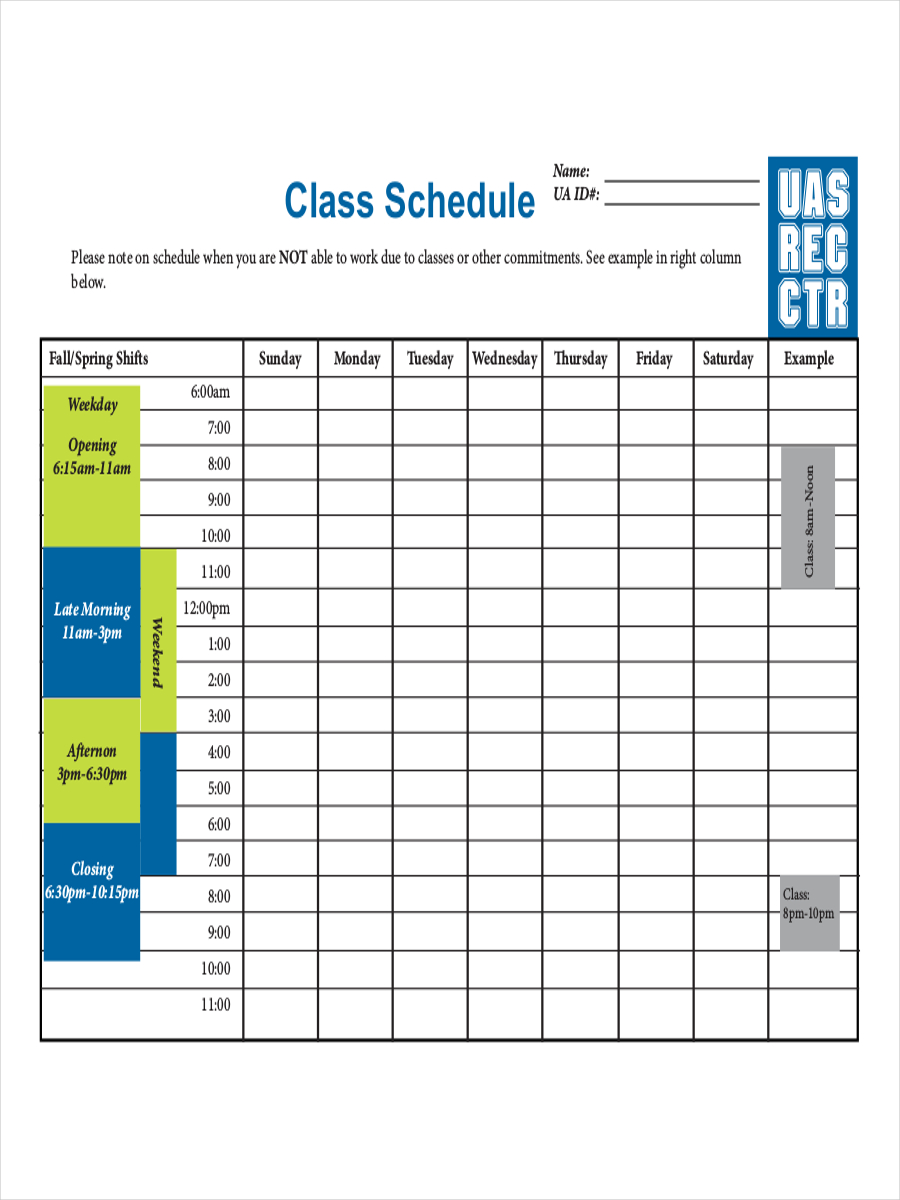

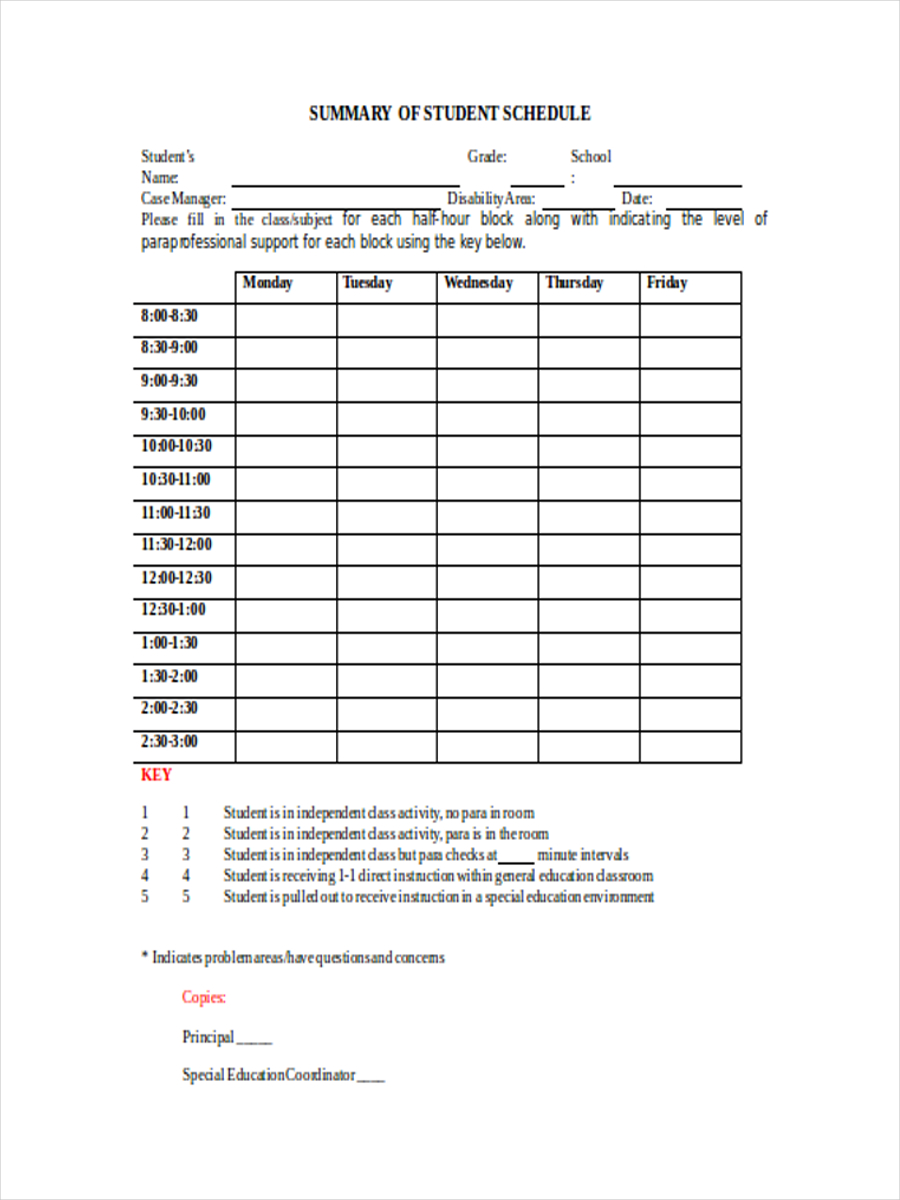

College Schedule Examples 6 Samples In Pdf Doc Examples

Amortization Schedule 10 Examples Format Sample Examples

2

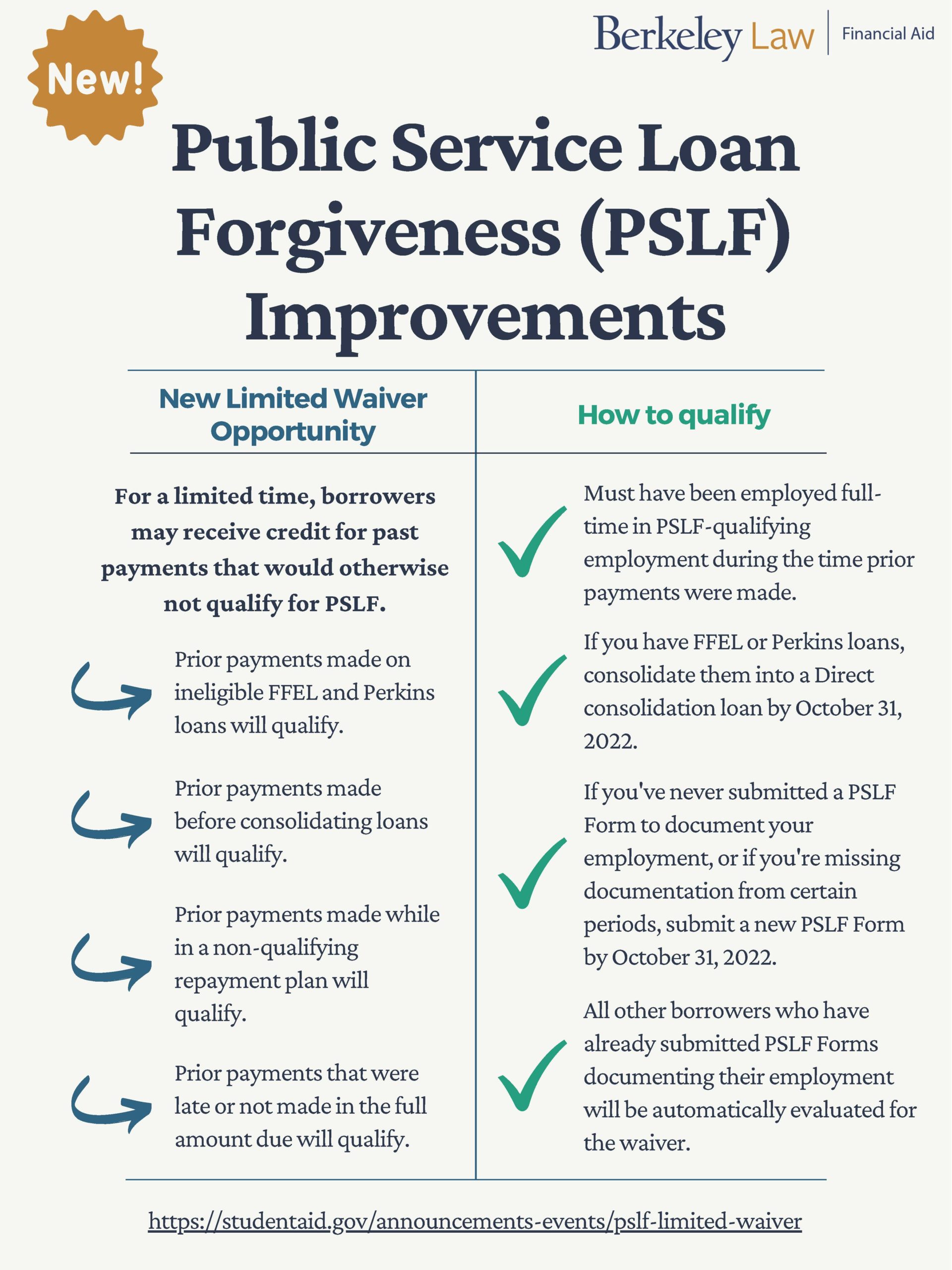

News Updates Berkeley Law

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Debt Calculator Loan Payoff Student Loans

College Schedule Examples 6 Samples In Pdf Doc Examples

Use Excel To Create A Loan Amortization Schedule That Includes Optional Extra Payment Amortization Schedule Mortgage Amortization Calculator Schedule Templates

Download The Simple Interest Loan Calculator From Vertex42 Com Amortization Schedule Mortgage Amortization Calculator Simple Interest

Credible Compare And Save On Your Student Loans Student Loans Student Loan Payment Refinance Student Loans

Amortization Schedule 10 Examples Format Sample Examples

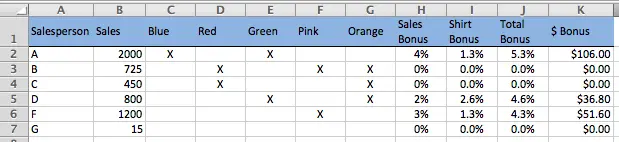

Using Multiple If Statements In Excel Learn Microsoft Excel Five Minute Lessons

Loan Amortization Schedule Template Amortization Schedule Schedule Templates Employee Handbook Template

Amortization Schedule 10 Examples Format Sample Examples

Pin On Get Yo Shit Together

B7uswu 8cn8bgm

Amortization Schedule 10 Examples Format Sample Examples

Amortization Schedule 10 Examples Format Sample Examples